London-based fintech leader The ClearScore Group has secured €36.1 million in debt financing from HSBC Innovation Banking UK to accelerate its growth and expand its product offerings. The latest funding injection marks another milestone in ClearScore’s long-standing partnership with HSBC Innovation Banking, which has supported the company’s expansion since 2017.

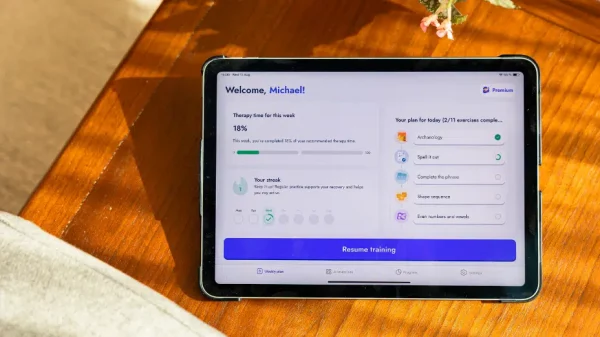

With over 24 million users across five countries, ClearScore has cemented itself as a major player in the financial technology sector. The platform provides users with free access to their credit scores and reports, personalized financial insights, and tools to enhance financial wellbeing—without impacting credit ratings. Its growing suite of services includes ‘Credit Health’ for comprehensive financial tracking and ‘Protect’ for identity theft monitoring.

Brian Cole, Chief Financial Officer at ClearScore, emphasized the company’s strong market position and ambitious growth plans: “As a profitable fintech operating at global scale, we’re in a good spot when it comes to choosing how to invest for the next ten years of growth. This funding allows us to expand the range of products we offer and enhance how we connect with users. HSBC Innovation Banking has been a key strategic partner in helping us scale rapidly and establish ClearScore as one of the UK’s leading fintech brands.”

The fresh capital also supports ClearScore’s strategic expansion, including mergers and acquisitions. A notable example is its recent acquisition of Manchester-based credit marketplace supplier Aro Finance, which strengthens ClearScore’s secured loan offerings and marks its entry into embedded finance.

Nick Conway, Director of FinTech Coverage at HSBC Innovation Banking UK, praised ClearScore’s trajectory: “ClearScore has been a valued long-term partner, and we’re thrilled to support their continued growth. This funding demonstrates our commitment to helping UK fintech firms scale and drive innovation in financial services.”

Founded in 2015 by Justin Basini, ClearScore started with a simple mission: to empower users with greater financial control. Since then, the company has expanded its portfolio to include DriveScore, a data-driven marketplace for motor finance, and D•One, an open banking service optimizing credit marketplaces. Today, ClearScore partners with over 160 financial institutions, including 90 industry-leading lenders, to provide tailored financial solutions to millions worldwide.

With this latest funding, ClearScore is poised to deepen its product innovation, scale its services, and further its mission of making financial wellbeing accessible to all.