They are one of the few Polish startups operating in the contech industry. As they said during our previous conversation, this is a difficult market, because the construction sector in Poland is very traditional, and consequently not very open to innovations. However, with the help of the just-raised million zlotys, their chances for success increase.

What are you going to spend the acquired million zlotys on?

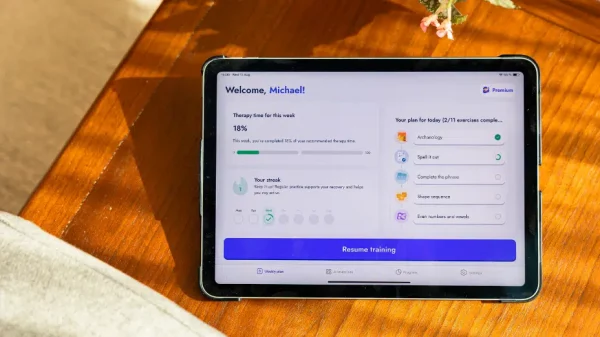

We are going to spend the funds raised on introducing the platform to a wide distribution in a SaaS formula. We want the users to get an intuitive tool, which they can configure according to their needs, without costly preliminary analyses and long time of waiting for the results of programmers’ work.

There is a lot of work to be done, because since the publication of the 2019 Autodesk report, which identified the lack of a collaborative culture as one of the biggest challenges of the Polish construction industry, unfortunately not much has changed: still only few investors do a thorough analysis that would involve all parties of the process – from the architect, to the contractors, to the investor – before starting a project. This is a big oversight, because a properly planned investment by all participants of the construction process is able to reduce both costs and implementation time. We want to talk about it loudly, because we have a tool that until now was not available for smaller construction companies.

When will we see your product on the market?

I’d like to say tomorrow, but the developers on the team wouldn’t be the happiest because the project is still in the testing phase. In startup nomenclature, we have entered the seventh level of technology readiness – the moment of testing the prototype in an operational environment, which allows us to catch the first improvements before the product is introduced to wide distribution.

We are conducting a pilot implementation in Blezat company, which is the right hand of many construction investors. We are open for further cooperation on preferential terms, feel free to contact us if someone would like us to implement the solution on his construction site.

Which solutions from the last months would you mention as significant (or even breakthrough) for the contech industry?

Breakthrough solutions are gaining momentum and slowly making their way into the mainstream. Here are the 5 most interesting trends in our opinion:

- Virtual design and construction (VDC) is currently experiencing the fastest growth among new construction technologies. These include systems used to model buildings before they are built in the real world, as well as complex design systems, the most popular of which is BIM. It is estimated that repair work for faulty or incorrect construction accounts for nearly 30% of construction industry costs. Virtual solutions help reduce these costs.

- Construction management systems (CMS) such as BinderLess. The global construction management software market is currently valued at $1.4 billion. It is expected to grow to $3.2 billion by 2027 (CAGR 12.5%).

- Modular and Prefabricated Structures. The global modular construction market was worth approximately $82.3 billion in 2020. It is expected to grow to $108.8 billion by 2025. Increasingly, general contractors, architects, and developers are turning to modular construction because it helps keep costs low, reduces construction time, and reduces waste.

- “Green building,” meaning any solution that helps fight pollution. A McKinsey survey found that 90% of construction industry respondents believe a shift toward sustainable construction is imminent.

- New building materials. If the cement sector were a country, it would be the third largest producer of carbon dioxide, ranking just behind China and the United States. That’s why new products are being developed, such as self-replicating concrete and biocement, that don’t have such a negative impact on the environment. For example, biocement is grown from biological materials rather than non-renewable materials, and the process of making it actually absorbs CO2 rather than emitting it.

When we spoke six months ago, you mentioned that there were few startups in the construction industry. Has the situation improved since then?

In our opinion, unfortunately not much has changed since then. The construction industry is still not taken by startups, at least in Poland. There is a very simple reason for this – startups are born in response to certain pains and problems, but in order to come up with something new, you first need to want to change the status quo, and construction lacks young innovators. This translates into a reduced prestige of working in construction, the consequences of which we will see in the future. Most of them choose more flexible work that can be done remotely. The situation is a bit different when it comes to foreign companies, especially American ones such as BuildingConnected, which raised $52.7M, or Safesite with $19.1M in Series A funding. New construction startups have raised over $1.3 billion in funding in 2020 alone, and advances in artificial intelligence (AI) and other technologies are expected to boost the industry’s profits over the next few years.

The construction industry in Poland has been very slow to implement innovation, so construction startups must balance the growing need for digitization with the industry’s willingness to implement innovative solutions.

What impact does the situation in Ukraine have on the construction industry in Poland? On the one hand it is negative (outflow of workers and reduced inflow of foreign investment in the sector), but on the other hand it is also positive (increased interest in warehouses, Ukrainian companies moving their operations to Poland). How does this situation affect your partners in the industry?

This is a very difficult time for the construction industry, as there is a shortage of both engineering staff and materials for construction investments. Foreign labor force significantly supports the situation on the market, it is estimated that Ukrainians constitute on average 60% of all employees of Polish construction companies, now due to the war many of them have been called up to the army. Of course, this will have a negative impact on the execution of contracts. Many companies that have signed long contracts for implementation have already maximized the possible penalties, which will cause many bankruptcies in the construction sector.